GLOBAL SELLING BLOG

How to check bill of entry status on ICEGATE: A step-by-step guide

You can check the status of a bill of entry (BOE) on the ICEGATE portal by providing the port code and BOE. Learn how in this blog.

All export goods must go through a specific set of procedures as stated by the Customs Office to ensure that authorities are charging the right taxes while checking consignments. This includes examination, assessment and evaluation of the goods. To allow the authorities to correctly and accurately inspect imported products, every consignment is made available with a set of official documents that contain all the details about the consignment. The bill of entry is one such important document.

It is submitted to the Customs department, so the clearance procedure is completed without any hindrance. Once a bill of entry is filed, the importer can claim ITC (Input Tax Credit) on goods. The filing of the bill of entry is done by an importer or Clearing House Agent (CHA).

It is submitted to the Customs department, so the clearance procedure is completed without any hindrance. Once a bill of entry is filed, the importer can claim ITC (Input Tax Credit) on goods. The filing of the bill of entry is done by an importer or Clearing House Agent (CHA).

Importance of checking bill of entry status

Bill of entry plays a crucial role in determining applicable tax levied on the exporter. The status is also important in determining the compensation cess collected during import and the IRC for the IGST.2

How to check bill of entry status online?

A bill of entry enables the government to maintain a record of the flow of goods to and from the country. With ICEGATE, filing a bill of entry has become easier. You can easily check the status of bill of entry on its portal1.

Step 1: Provide the location using the port code.

Step 2: Enter BOE number.

Step 3: Enter date and click on submit.

Step 1: Provide the location using the port code.

Step 2: Enter BOE number.

Step 3: Enter date and click on submit.

Step 1:

Go to the GST official website.

Step 2:

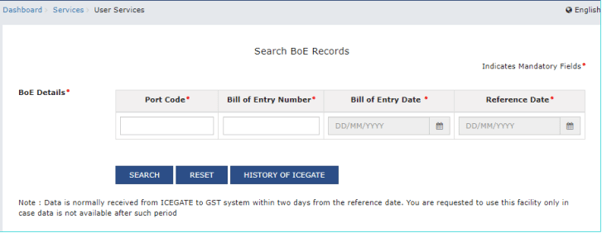

On the GST homepage, click the Services tab. A drop-down will occur, then click User Services > Search BOE Option.

Step 3:

Then, the Search BOE records page is displayed.

Step 4:

In this, enter the port code, BOE number, BOE date, and reference date. Click on the ‘Search’ button.

Note: The reference date is the date when the products have been cleared from customs (passed out of the customs charge). The reference date will either be charge date, Duty payment date, or amendment date, whichever is later.

Note: The reference date is the date when the products have been cleared from customs (passed out of the customs charge). The reference date will either be charge date, Duty payment date, or amendment date, whichever is later.

Step 5:

Search results are displayed on your screen.

Step 5.1:

a) You can click on the ‘Query ICEGATE’ button to generate the on-demand fetching of the latest BoE records from ICEGATE. In case the most recent records are not available on the GST portal.

b) You can click on the ‘Reset’ button to reset the data entered in the fields.

b) You can click on the ‘Reset’ button to reset the data entered in the fields.

Step 6:

History of fetched Bill of Entry details from ICEGATE, along with the status of the query, are displayed. You can click the ‘BACK’ button to go back to the Search Bill of Entry Records page.

What contents does a bill of entry have?

Some of the major components in a bill of entry form are:

• Name and business address of importer, Customs House Agent

• IEC

• Monetary value and description of the goods

• Name and business address of the exporter

• Destination port

• Importer’s license number

• Rate payable and import duty’s value

• Port code (A BOE number contains 13 digits – the first of which are Port Codes)

• Name and business address of importer, Customs House Agent

• IEC

• Monetary value and description of the goods

• Name and business address of the exporter

• Destination port

• Importer’s license number

• Rate payable and import duty’s value

• Port code (A BOE number contains 13 digits – the first of which are Port Codes)

Obtaining a bill of entry and other required documents is important for your export business. You can sell internationally from India using e-commerce in a simple way.

Easy e-commerce exports with Amazon Global Selling

Amazon Global Selling is an e-commerce exports program that helps Indian exporters take their products across the world. With third-party expert assistance to obtain documents like Bill of Entry and support in logistics, Amazon simplifies exports for local sellers and MSMEs and enables them to sell on international marketplaces without hassles.

Frequently Asked Questions

What should be checked in a Bill of Entry?

The importer’s IGST, GST and custom duty details are checked in a Bill of Entry.

Can a Bill of Entry be cancelled?

Yes, a Bill of Entry can be cancelled. Just click cancel the Bill of Entry related to the purchase order on the ICEGATE portal.

How many types of the BOE are there?

There are three types of BOE4:

I) BOE for house consumption

II) BOE for warehousing

III) BOE for Ex-bonds Goods

I) BOE for house consumption

II) BOE for warehousing

III) BOE for Ex-bonds Goods

Who provides or issues a Bill of Entry?

Bill of Entry is a formal and legal document that an importer files with the customs department to get clearance.

How do I get a copy of the Bill of Entry?

The copy of Bill of Entry can be obtained from the official website of ICEGATE. The importer can also approach the authorized bank to get an attested or certified copy of the Bill of Entry.

Published on September 30, 2022.

Sources:

1. https://cleartax.in/s/check-icegate-bill-of-entry-status

2. https://cleartax.in/s/check-icegate-bill-of-entry-status

3. https://cleartax.in/s/check-icegate-bill-of-entry-status

4. https://www.tradefinanceglobal.com/freight-forwarding/difference-between-igm-bill-of-entry/

5. https://cleartax.in/s/check-icegate-bill-of-entry-status

6. https://cleartax.in/s/check-icegate-bill-of-entry-status

7. https://www.mastersindia.co/blog/bill-of-entry/

8. https://cleartax.in/s/check-icegate-bill-of-entry-status

9. https://www.icegate.gov.in/help/faq

Sources:

1. https://cleartax.in/s/check-icegate-bill-of-entry-status

2. https://cleartax.in/s/check-icegate-bill-of-entry-status

3. https://cleartax.in/s/check-icegate-bill-of-entry-status

4. https://www.tradefinanceglobal.com/freight-forwarding/difference-between-igm-bill-of-entry/

5. https://cleartax.in/s/check-icegate-bill-of-entry-status

6. https://cleartax.in/s/check-icegate-bill-of-entry-status

7. https://www.mastersindia.co/blog/bill-of-entry/

8. https://cleartax.in/s/check-icegate-bill-of-entry-status

9. https://www.icegate.gov.in/help/faq

Sell across the world with Amazon Global Selling

Ready to start exporting from India?

Want to learn about Amazon Global Selling?

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

*Map not to scale. The map has been used for design and representational purpose only, it does not depict the geographical boundaries of the country. These do not conform to the external boundaries of India recognized by the Survey of India.

*Map not to scale. The map has been used for design and representational purpose only, it does not depict the geographical boundaries of the country. These do not conform to the external boundaries of India recognized by the Survey of India.

Get started with $50,000 in potential incentives.