Here's how the Goods and Services Tax (GST) works

In our previous blog post we briefly covered a quick introduction to GST. Today, we will talk about how the proposed Goods and Services Tax is expected to work with Flowchart image references for your understanding.

Under the GST system of taxation, you will need to keep in mind the following:

>The taxes paid at each stage (e.g. Manufacturer > Distributor > Retailer) will be available in the next stage of value addition. This makes GST, a tax which is levied only on the value addition at each stage)

>The final consumer will only have to pay the tax/GST charged by the last dealer in the supply chain with the set of benefits at all the previous stages

>GST is proposed to be implemented as a dual GST with the Centre and State governments simultaneously levying GST across the value chain.

GST for transactions within a State.

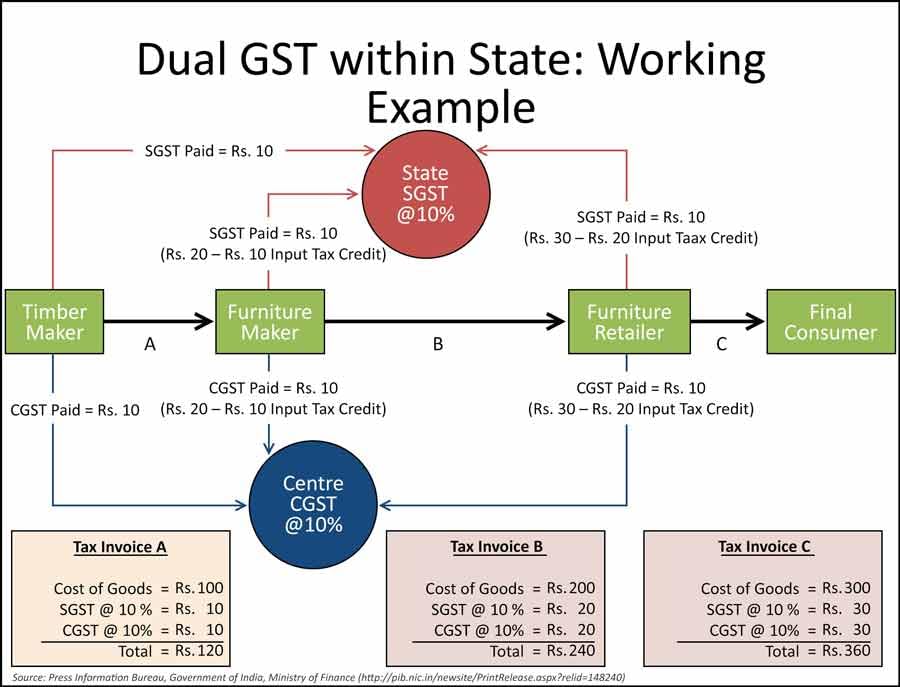

For all transactions within a state (goods or services), there will be 2 components of GST:

>CGST (Central GST) which will be levied by the Central Government

>SGST (State GST) which will be levied by the State Government

Below is an example of how both the above taxes will work. The below table also explains how the credit of input taxes is available from one stage in the next stage.

Under the GST system of taxation, you will need to keep in mind the following:

>The taxes paid at each stage (e.g. Manufacturer > Distributor > Retailer) will be available in the next stage of value addition. This makes GST, a tax which is levied only on the value addition at each stage)

>The final consumer will only have to pay the tax/GST charged by the last dealer in the supply chain with the set of benefits at all the previous stages

>GST is proposed to be implemented as a dual GST with the Centre and State governments simultaneously levying GST across the value chain.

GST for transactions within a State.

For all transactions within a state (goods or services), there will be 2 components of GST:

>CGST (Central GST) which will be levied by the Central Government

>SGST (State GST) which will be levied by the State Government

Below is an example of how both the above taxes will work. The below table also explains how the credit of input taxes is available from one stage in the next stage.

GST for Inter-State transactions

The Integrated GST ("IGST") will be implemented in the following manner:

>It is the sum of CGST and SGST and is levied by the Central Government

>The Central Government will collect the IGST

>The exporting state will transfer to the Central Government the credit of SGST used in payment of IGST

>The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own state

>The Central Government will transfer to the importing state the credit of IGST used in payment of SGST

Below is an example of how the Integrated GST will work:

The Integrated GST ("IGST") will be implemented in the following manner:

>It is the sum of CGST and SGST and is levied by the Central Government

>The Central Government will collect the IGST

>The exporting state will transfer to the Central Government the credit of SGST used in payment of IGST

>The importing dealer will claim credit of IGST while discharging his output tax liability (both CGST and SGST) in his own state

>The Central Government will transfer to the importing state the credit of IGST used in payment of SGST

Below is an example of how the Integrated GST will work:

What are some of the benefits of GST?

>Easy compliance: A robust and comprehensive IT system would be the foundation of the GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online.

>Uniformity of tax rates and structures: GST will ensure that indirect tax rates and structures are common across India, thereby increasing certainty and ease of doing business.

>Removal of cascading: A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes.

>Improved competitiveness: Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade and industry.

>Gain to manufacturers and exporters: The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services. The uniformity in tax rates and procedures across India will also go a long way in reducing the compliance cost.

We hope this article helped you understand the GST framework much better.

You can now apply for GST using our exclusive offer on Amazon Sellers by clicking here. Note: The content/ information mentioned above with respect to GST has been derived by Amazon Seller Services Private Limited ("Amazon") from the Press Information Bureau and GSTIndia.com is only for informational purposes. Amazon does not guarantee whatsoever as to the accuracy; completeness or usefulness of any information contained herein and assumes no responsibility for consequences resulting from the use of the information thereof. Please reach out to your Tax Consultant or GST service provider for any clarifications/ queries regarding GST.

>Easy compliance: A robust and comprehensive IT system would be the foundation of the GST regime in India. Therefore, all tax payer services such as registrations, returns, payments, etc. would be available to the taxpayers online.

>Uniformity of tax rates and structures: GST will ensure that indirect tax rates and structures are common across India, thereby increasing certainty and ease of doing business.

>Removal of cascading: A system of seamless tax-credits throughout the value-chain, and across boundaries of States, would ensure that there is minimal cascading of taxes.

>Improved competitiveness: Reduction in transaction costs of doing business would eventually lead to an improved competitiveness for the trade and industry.

>Gain to manufacturers and exporters: The subsuming of major Central and State taxes in GST, complete and comprehensive set-off of input goods and services and phasing out of Central Sales Tax (CST) would reduce the cost of locally manufactured goods and services. The uniformity in tax rates and procedures across India will also go a long way in reducing the compliance cost.

We hope this article helped you understand the GST framework much better.

You can now apply for GST using our exclusive offer on Amazon Sellers by clicking here. Note: The content/ information mentioned above with respect to GST has been derived by Amazon Seller Services Private Limited ("Amazon") from the Press Information Bureau and GSTIndia.com is only for informational purposes. Amazon does not guarantee whatsoever as to the accuracy; completeness or usefulness of any information contained herein and assumes no responsibility for consequences resulting from the use of the information thereof. Please reach out to your Tax Consultant or GST service provider for any clarifications/ queries regarding GST.

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

Latest Articles

Become a Seller today

Put your products in front of the crores of customers on Amazon every day.

It takes only 15 minutes to setup your account