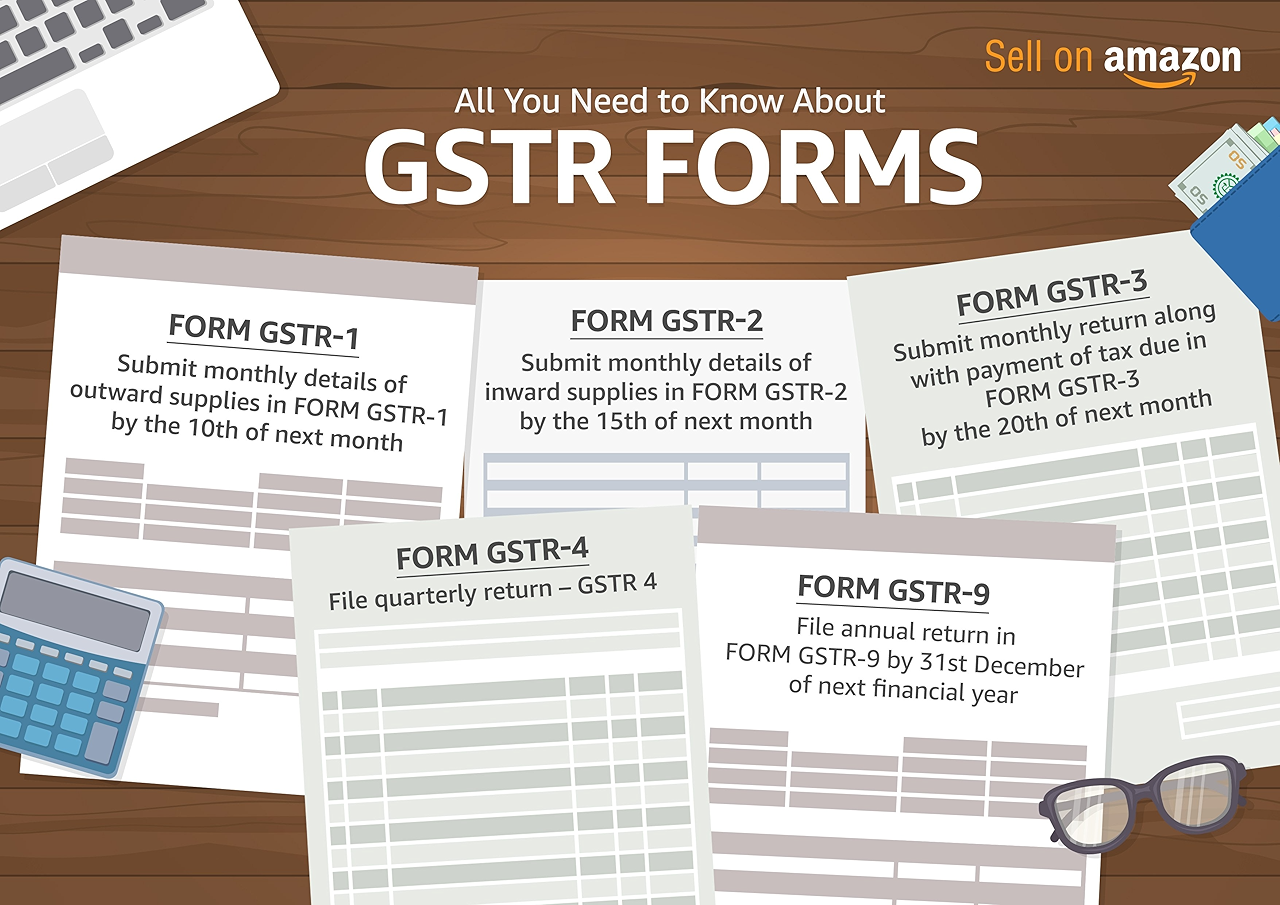

All you need to know about GSTR forms

FORM GSTR-1

Submit monthly details of outward supplies in Form GSTR-1 by the 10th of next month. This form contains

>Basic details like Business Name along with Goods and Service Taxpayer Identification Number (GSTIN), period for which the return is being filed, etc.

>Details of invoices issued in the previous month and the corresponding taxes to be paid.

>Details of advances received against a supply to be made in future.

>Details of revision in relation to outward sales invoices pertaining to previous tax periods.

FORM GSTR-2

Submit monthly details of inward supplies in Form GSTR-2 by the 15th of next month.

GSTR-2 includes details of the inward supplies or purchases of goods and/or services by the taxpayer. Data in GSTR-2 is auto populated based on the GSTR-1 filed by the taxpayer. You (as the taxpayer) just have to validate this auto populated information on the GSTN portal and make modifications, if required. For example, if you are buying goods from company B, then company B would have filed its GSTR-1 and included your name and GSTINas the buyer. Accordingly, the same information will be reflected in your GSTR-2 as purchases which you need to validate. GSTR-2 will thus include the details of auto-populated purchases.

There is no option to revise the GSTR-2. However, rectification (if any) is to be made in the GSTR-2 for consecutive months.

FORM GSTR-3

Submit monthly return along with payment of tax due in Form GSTR-3 by the 20th of next month.

GSTR-3 is a combined version of GSTR-1 and GSTR-2 with details of sales provided under GSTR-1 and details of purchases mentioned in GSTR-2 along with the GST liability for the month. You (as the taxpayer) just have to validate this auto populated information and make modifications, if required.

GSTR-3 includes the following details:

>Information about input tax credit ledger, cash ledger, and liability ledger of the taxpayer.

>Details of payment of tax as CGST, SGST, and IGST.

>Taxpayer will have the option of claiming a refund of excess payment or to carry forward the credit.

FORM GSTR-3B

To address the concerns raised by the various trade and industrial bodies, and to ensure the smooth roll out of GST, the GST Council decided to extend the timeline for invoice-wise return filing in Form GSTR-1 and Form GSTR-2 for a period of six months, i.e. up to December, 2017. Now businesses need to file a simple return in Form GSTR-3B by declaring the summary of inward supplies and outward supplies.

FORM GSTR-4

Submit quarterly return in Form GSTR-4 by 18th of the month after the end of a quarter.

A small taxpayer (i.e. a taxpayer with a turnover of up to Rs. 1 Crore) has the option to opt for the composition scheme. In such a case, he would be required to pay taxes at a fixed rate depending on the type of his business (2% for manufacturers, 5% for restaurant service sector and 1% for other suppliers). Although no input tax credit facility would be available under the composite scheme. A taxpayer opting for the composition scheme would be required to file a simplified quarterly return in Form GSTR-4. GSTR-4 includes the following details:

>The total value of consolidated supply made during the period of return, i.e. during the quarter.

>Details of payment of tax.

>Declare invoice-level purchase information.

FORM GSTR-9

Submit annual return in Form GSTR-9 of Form GSTR-9A by 31st December of next financial year:

All taxpayers would be required to submit an annual return under the GST regime in Form GSTR-9. This is intended to provide complete visibility about the activities of the taxpayer. However, any taxable person registered under composition scheme and filing quarterly in Form GSTR-4 is required to submit the annual return in Form GSTR-9A.

Key features of the annual return form:

>It will be a detailed return and will capture details of the income and expenditure of the taxpayer and will regroup the same with the monthly returns.

>A major advantage of this return will be that it provides the opportunity to correct any short reporting of activities undertaken.

>The system will automatically reconcile all the data filed earlier and determine tax liability payable if any against the tax actually paid.

>The due date for filing the return is 31st December of every year in respect of the financial year ending on 31st March of that year. The same has to be filed along with the audited copies of the annual accounts of the taxpayer.

For any GST related queries, please contact your tax consultant or a GST Suvidha Provider. There is certain software available that enables you to manage your business and help you file the relevant GST return forms. For e.g., you can consider the Tally.ERP software which can help you manage your inventory and can generate your required GST return forms. For a detailed explanation of the Goods and Services Tax, you can read our post here. If you are not a seller on Amazon.in, you can start your journey today.

Submit monthly details of outward supplies in Form GSTR-1 by the 10th of next month. This form contains

>Basic details like Business Name along with Goods and Service Taxpayer Identification Number (GSTIN), period for which the return is being filed, etc.

>Details of invoices issued in the previous month and the corresponding taxes to be paid.

>Details of advances received against a supply to be made in future.

>Details of revision in relation to outward sales invoices pertaining to previous tax periods.

FORM GSTR-2

Submit monthly details of inward supplies in Form GSTR-2 by the 15th of next month.

GSTR-2 includes details of the inward supplies or purchases of goods and/or services by the taxpayer. Data in GSTR-2 is auto populated based on the GSTR-1 filed by the taxpayer. You (as the taxpayer) just have to validate this auto populated information on the GSTN portal and make modifications, if required. For example, if you are buying goods from company B, then company B would have filed its GSTR-1 and included your name and GSTINas the buyer. Accordingly, the same information will be reflected in your GSTR-2 as purchases which you need to validate. GSTR-2 will thus include the details of auto-populated purchases.

There is no option to revise the GSTR-2. However, rectification (if any) is to be made in the GSTR-2 for consecutive months.

FORM GSTR-3

Submit monthly return along with payment of tax due in Form GSTR-3 by the 20th of next month.

GSTR-3 is a combined version of GSTR-1 and GSTR-2 with details of sales provided under GSTR-1 and details of purchases mentioned in GSTR-2 along with the GST liability for the month. You (as the taxpayer) just have to validate this auto populated information and make modifications, if required.

GSTR-3 includes the following details:

>Information about input tax credit ledger, cash ledger, and liability ledger of the taxpayer.

>Details of payment of tax as CGST, SGST, and IGST.

>Taxpayer will have the option of claiming a refund of excess payment or to carry forward the credit.

FORM GSTR-3B

To address the concerns raised by the various trade and industrial bodies, and to ensure the smooth roll out of GST, the GST Council decided to extend the timeline for invoice-wise return filing in Form GSTR-1 and Form GSTR-2 for a period of six months, i.e. up to December, 2017. Now businesses need to file a simple return in Form GSTR-3B by declaring the summary of inward supplies and outward supplies.

FORM GSTR-4

Submit quarterly return in Form GSTR-4 by 18th of the month after the end of a quarter.

A small taxpayer (i.e. a taxpayer with a turnover of up to Rs. 1 Crore) has the option to opt for the composition scheme. In such a case, he would be required to pay taxes at a fixed rate depending on the type of his business (2% for manufacturers, 5% for restaurant service sector and 1% for other suppliers). Although no input tax credit facility would be available under the composite scheme. A taxpayer opting for the composition scheme would be required to file a simplified quarterly return in Form GSTR-4. GSTR-4 includes the following details:

>The total value of consolidated supply made during the period of return, i.e. during the quarter.

>Details of payment of tax.

>Declare invoice-level purchase information.

FORM GSTR-9

Submit annual return in Form GSTR-9 of Form GSTR-9A by 31st December of next financial year:

All taxpayers would be required to submit an annual return under the GST regime in Form GSTR-9. This is intended to provide complete visibility about the activities of the taxpayer. However, any taxable person registered under composition scheme and filing quarterly in Form GSTR-4 is required to submit the annual return in Form GSTR-9A.

Key features of the annual return form:

>It will be a detailed return and will capture details of the income and expenditure of the taxpayer and will regroup the same with the monthly returns.

>A major advantage of this return will be that it provides the opportunity to correct any short reporting of activities undertaken.

>The system will automatically reconcile all the data filed earlier and determine tax liability payable if any against the tax actually paid.

>The due date for filing the return is 31st December of every year in respect of the financial year ending on 31st March of that year. The same has to be filed along with the audited copies of the annual accounts of the taxpayer.

For any GST related queries, please contact your tax consultant or a GST Suvidha Provider. There is certain software available that enables you to manage your business and help you file the relevant GST return forms. For e.g., you can consider the Tally.ERP software which can help you manage your inventory and can generate your required GST return forms. For a detailed explanation of the Goods and Services Tax, you can read our post here. If you are not a seller on Amazon.in, you can start your journey today.

Disclaimer: Whilst Amazon Seller Services Private Limited ("Amazon") has used reasonable endeavours in compiling the information provided, Amazon provides no assurance as to its accuracy, completeness or usefulness or that such information is error-free. In certain cases, the blog is provided by a third-party seller and is made available on an "as-is" basis. Amazon hereby disclaims any and all liability and assumes no responsibility whatsoever for consequences resulting from use of such information. Information provided may be changed or updated at any time, without any prior notice. You agree to use the information, at your own risk and expressly waive any and all claims, rights of action and/or remedies (under law or otherwise) that you may have against Amazon arising out of or in connection with the use of such information. Any copying, redistribution or republication of the information, or any portion thereof, without prior written consent of Amazon is strictly prohibited.

Latest Articles

Become a Seller today

Put your products in front of the crores of customers on Amazon every day.

It takes only 15 minutes to setup your account